Need help with a home equity loan or a refi

Polkie918

Posts: 245

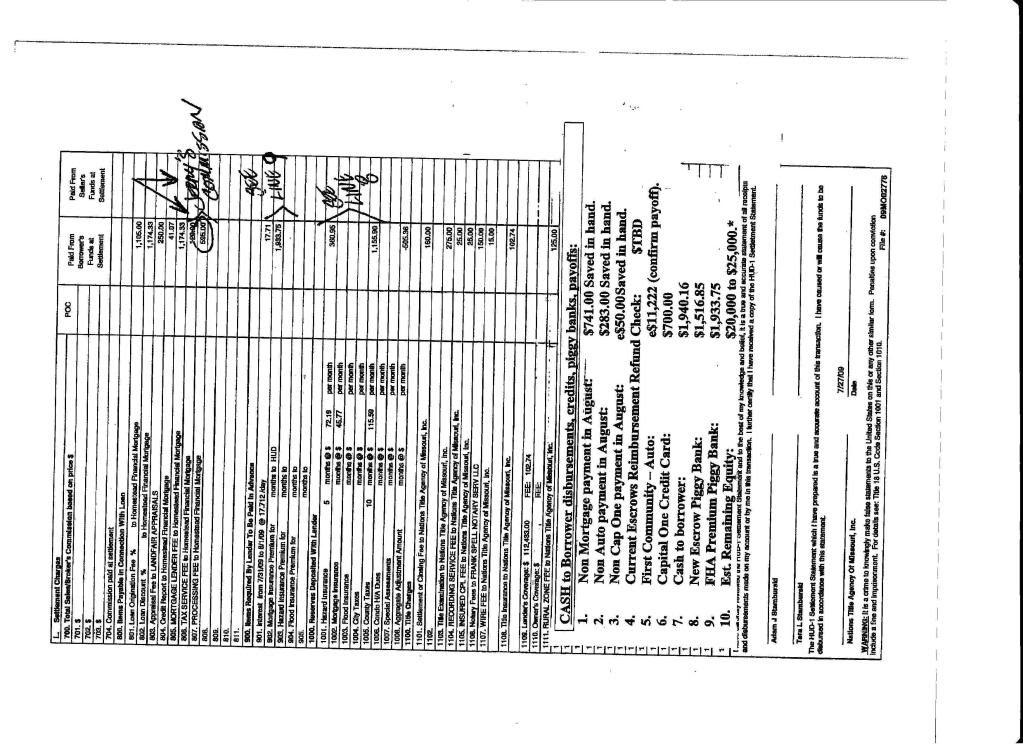

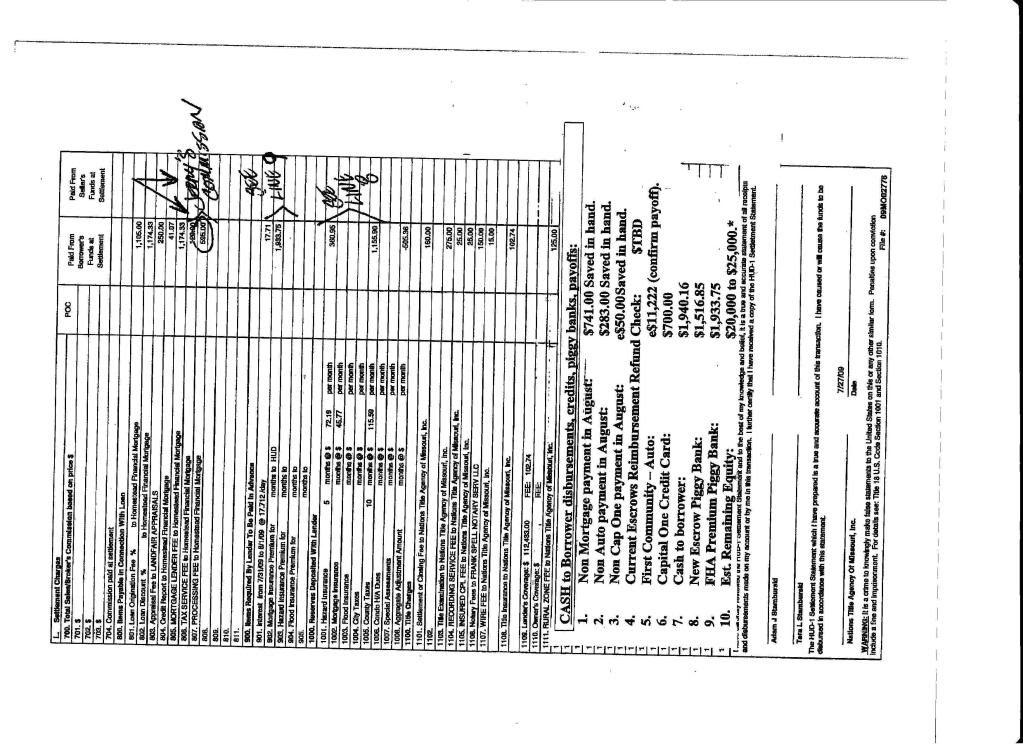

trying to get a home equity loan or a refi......dont understand some of the fee's on this paper....we are trying to go through granny 8 which is homestead financial....

they refer to some items as "piggy banks" such as line 8 and 9.....then hopefully u can see it....line 801 loan origination fee $1,174 then loan discount % $1,174......

we currently have 6.5% rate and with this new one it would drop down to 5.75%

any help would be great if u need more info please let me know i can give u some numbers...thanks

they refer to some items as "piggy banks" such as line 8 and 9.....then hopefully u can see it....line 801 loan origination fee $1,174 then loan discount % $1,174......

we currently have 6.5% rate and with this new one it would drop down to 5.75%

any help would be great if u need more info please let me know i can give u some numbers...thanks

Fronts- RTi8

Center- CSi5

Rears- FXiA4

Sub- Velodyne 12"

Onkyo TX-SR806

Ps3

Xbox 360

65" DLP 1080P Toshiba TV

Center- CSi5

Rears- FXiA4

Sub- Velodyne 12"

Onkyo TX-SR806

Ps3

Xbox 360

65" DLP 1080P Toshiba TV

Post edited by Polkie918 on

Comments

-

It looks like the "Piggy Bank" on line 9 is what they are calling the PMI, or Private Mortgage Insurance. It's there if you don't have 20% down payment on the house. They may have just paid it all up front instead of adding it in to your monthly payments. Line 8 just seems to be your house insurance and taxes.

-

when we got the original loan, we had the down payment.....is that line 9 there because this is a refi?Fronts- RTi8

Center- CSi5

Rears- FXiA4

Sub- Velodyne 12"

Onkyo TX-SR806

Ps3

Xbox 360

65" DLP 1080P Toshiba TV -

"Piggy Bank" is just a gimmicky term for funds being held in escrow for future payments. Line 8 is prepaid property taxes and and prepaid homeowners insurance premiums. Part of every monthly payment goes into an escrow account to sure the lender has enough funds to make those annual payments when due. They collect an amount in advance (usually a certain number of months) to make sure there is always more than enough to make those payments.

Line 9 is the up-front FHA morgage insurance premium (MIP) because you are financing an amount greater than 80% of the value of the home or your credit scores are not high enough or a combination of both. You pay the fee at closing and a monthy fee as well.

You are paying a lot to get a .75% decrease in rate. You are paying $3,500 in lenders fees and points, another $2,000 in FHA fees plus all of the other closing costs just to get a slightly lower rate. You are evidently doing some debt consolidation as well. As a lender, I would probably make sure you understand what you are doing. Are you looking for a lower monthly payment by consolidating your car payment and mortgage payment?

From what I can see, it may not be a financially smart thing to do unless the current payments are more than you can handle. Unless you just have to do it you are paying a very high price to get there IMO."Just because youre offended doesnt mean youre right." - Ricky Gervais

"For those who believe, no proof is necessary. For those who don't believe, no proof is possible." - Stuart Chase

"Consistency requires you to be as ignorant today as you were a year ago." - Bernard Berenson -

yea I know its expensive, but I have to pay back my grandma and dad a total of $7500 they loaned me for the original closing clost and stuff.....we also are gonna pay off some bills and try to get a deck.....so we need the money....I hate paying that much but we need to....

they said that the line 9 MIP would get refunded to us from the lender before which was wells fargo, the new company will be paying the loan off and WF will have to refund us that money...

they also said over the term of the loan we will be saving like $82k..........

and our house payment right now is $741 ( we pay my dad back each month $140 to pay down that loan for our closing) so that would be $890 a month

after everything is said and done with the new loan our payment is gonna be $889 a month

make sense? ask me any other questions u may have please thanksFronts- RTi8

Center- CSi5

Rears- FXiA4

Sub- Velodyne 12"

Onkyo TX-SR806

Ps3

Xbox 360

65" DLP 1080P Toshiba TV -

I guess they are setting the MIP aside until they see how much you get back from WF. Some of the MIP is refundable if you refinance within 3 years. There is a sliding scale depending on how long you have had this mortgage so WF will only refund part of what you paid. Here is the chart:

Refunds of upfront premiums are available to borrowers refinancing to another FHA-insured mortgage within a three-year time period, as shown below. they also said over the term of the loan we will be saving like $82k..........

they also said over the term of the loan we will be saving like $82k..........

and our house payment right now is $741 ( we pay my dad back each month $140 to pay down that loan for our closing) so that would be $890 a month

after everything is said and done with the new loan our payment is gonna be $889 a month

make sense?

NO. Again you are only lowering your rate by .75%. Are you going from a 30 year mortgage to a 15 year mortgage? Are you making bi-weekly payments instead of monthly payments? Those are the only scenarios i can think of where you could even come close to saving $82K."Just because youre offended doesnt mean youre right." - Ricky Gervais

"For those who believe, no proof is necessary. For those who don't believe, no proof is possible." - Stuart Chase

"Consistency requires you to be as ignorant today as you were a year ago." - Bernard Berenson