What is "effective tax rate" for an individual filing a tax return?

kevhed72

Posts: 5,146

Comments

-

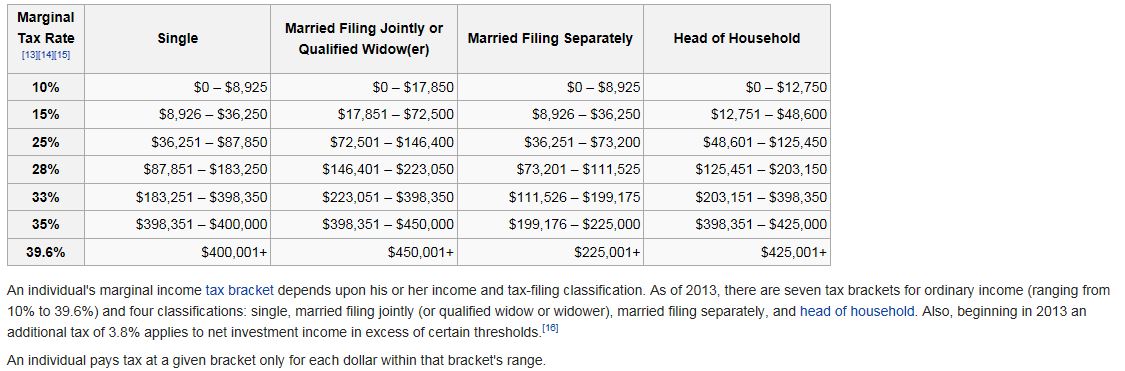

Depends on how much you make.

From Wiki Speakers: SDA-1C (most all the goodies)

Speakers: SDA-1C (most all the goodies)

Preamp: Joule Electra LA-150 MKII SE

Amp: Wright WPA 50-50 EAT KT88s

Analog: Marantz TT-15S1 MBS Glider SL| Wright WPP100C Amperex BB 6er5 and 7316 & WPM-100 SUT

Digital: Mac mini 2.3GHz dual-core i5 8g RAM 1.5 TB HDD Music Server Amarra (memory play) - USB - W4S DAC 2

Cables: Mits S3 IC and Spk cables| PS Audio PCs -

Finished ours yesterday, paying big time....FRAAAK!!!

-

"Effective tax rate" has different meanings in different contexts, but it is not "marginal tax rate," which is what the table above seems to focus on.

I think the meaning of "effective tax rate" in common parlance (versus the various technical definitions the accountants could provide) would be best described as the ratio of the total dollars paid in taxes over gross income.

The idea is to provide a measure of the percentage of total income -- before deductions and adjustments -- that goes to pay taxes. In some cases, the term may be used to apply only to income taxes; in others, it may be used to capture all state, local and federal taxes, including property taxes, sales taxes, etc.

But, I'm no accountant or tax lawyer. Perhaps, some real experts can define "effective tax rate" for us.Family Room, Innuos Statement streamer (Roon Core) with Morrow Audio USB cable to McIntosh MC 2700 pre with DC2 Digital Audio Module; AQ Sky XLRs to CAT 600.2 dualmono amp, Morrow Elite Speaker Cables to NOLA Baby Grand Reference Gold 3 speakers. Power source for all components: Silver Circle Audio Pure Power One with dedicated 20 amp circuit to main panel.

Exercise Room, Innuos Streamer via Cat 6 cable connection to PS Audio PerfectWave MkII DAC w/Bridge II, AQ King Cobra RCAs to Perreaux PMF3150 amp (fully restored and upgraded by Jeffrey Jackson, Precision Audio Labs), Supra Rondo 4x2.5 Speaker Cables to SDA 1Cs (Vr3 Mods Xovers and other mods.), Dreadnaught with Supra Rondo 4x2.5 interconnect cables by Vr3 Mods. Power for each component from dedicated 20 amp circuit to main panel, except Innuos Statement powered from Silver Circle Audio Pure Power One. -

I got 30k to pay in according to H&R!!

-

^ with the money you seem to have to spend on gear, you might want to use an actual accountant rather than the block. Kinda like not paying for insurance when shipping stuff... stuff happens.2-ch System: Parasound P/LD 2000 pre, Parasound HCA-1000 amp, Parasound T/DQ Tuner, Phase Technology PC-100 Tower speakers, Technics SL-1600 Turntable, Denon 2910 SACD/CD player, Peachtree DAC iT and X1asynchorus USB converter, HSU VTF-3 subwoofer.

-

The only tax rate I know is "screwed".The Gear... Carver "Statement" Mono-blocks, Mcintosh C2800 Arcam AVR20, Oppo UDP-203 4K Blu-ray player, Sony XBR70x850B 4k, Polk Audio Legend L800 with height modules, L400 Center Channel Polk audio AB800 "in-wall" surrounds. Marantz MM7025 stereo amp. Simaudio Moon MiND2 Shunyata Triton

“When once a Republic is corrupted, there is no possibility of remedying any of the growing evils but by removing the corruption and restoring its lost principles; every other correction is either useless or a new evil.”— Thomas Jefferson

How many flies need to be buzzing a dead horse before you guys stop beating it? -

Effective tax rate is simple. Take your total income, subtract your deductions, to figure your total taxable income. Then you find out how much you owe in taxes, social security and medicare don't count, but state taxes due, except sales tax. Find the percentage of money owed to taxes, and you have the effective tax rate. Forgot one, property taxes, and various fees to whatever don't count also.

If you take into account all taxes, fees, and price mark ups to every item you purchase, you'll find that you're paying north of 40% in taxes, but only taxes on income collected by state and federal government counts toward effective rate, because it sounds better. -

polkfarmboy wrote: »I got 30k to pay in according to H&R!